Details of the JPX competition

Description:

This competition will compare your models against real future returns after the training phase is complete. The competition will involve building portfolios from the stocks eligible for predictions (around 2,000 stocks). Specifically, each participant ranks the stocks from highest to lowest expected returns and is evaluated on the difference in returns between the top and bottom 200 stocks. You’ll have access to financial data from the Japanese market, such as stock information and historical stock prices to train and test your model.

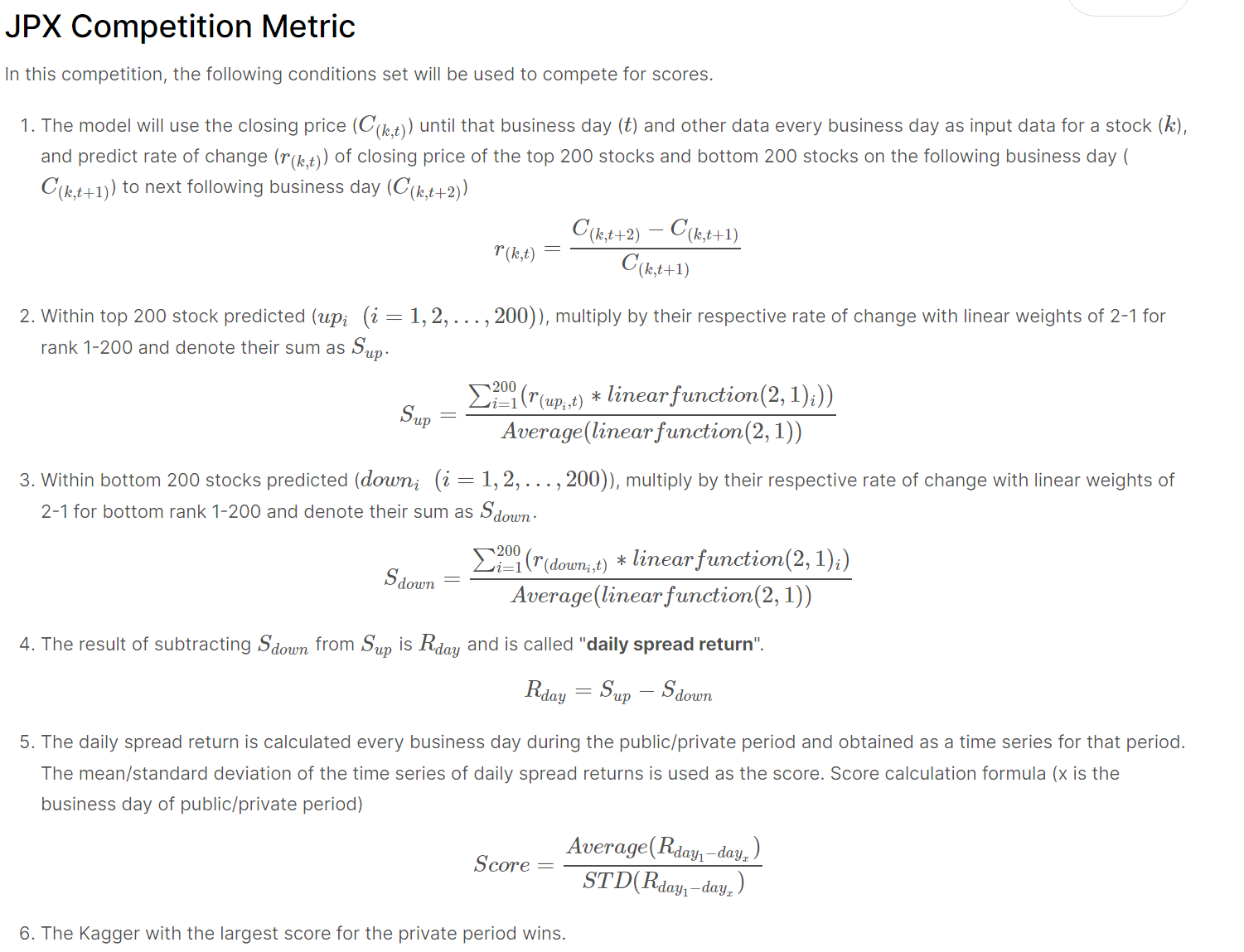

There are 2000 stocks that have to be ranked daily based on a kind of sharpe ratio calculation:

and here is code to calculate it:

def calc_spread_return_sharpe(df: pd.DataFrame, portfolio_size: int = 200, toprank_weight_ratio: float = 2) -> float:

"""

Args:

df (pd.DataFrame): predicted results

portfolio_size (int): # of equities to buy/sell

toprank_weight_ratio (float): the relative weight of the most highly ranked stock compared to the least.

Returns:

(float): sharpe ratio

"""

def _calc_spread_return_per_day(df, portfolio_size, toprank_weight_ratio):

"""

Args:

df (pd.DataFrame): predicted results

portfolio_size (int): # of equities to buy/sell

toprank_weight_ratio (float): the relative weight of the most highly ranked stock compared to the least.

Returns:

(float): spread return

"""

assert df['Rank'].min() == 0

assert df['Rank'].max() == len(df['Rank']) - 1

weights = np.linspace(start=toprank_weight_ratio, stop=1, num=portfolio_size)

purchase = (df.sort_values(by='Rank')['Target'][:portfolio_size] * weights).sum() / weights.mean()

short = (df.sort_values(by='Rank', ascending=False)['Target'][:portfolio_size] * weights).sum() / weights.mean()

return purchase - short

buf = df.groupby('Date').apply(_calc_spread_return_per_day, portfolio_size, toprank_weight_ratio)

sharpe_ratio = buf.mean() / buf.std()

return sharpe_ratio

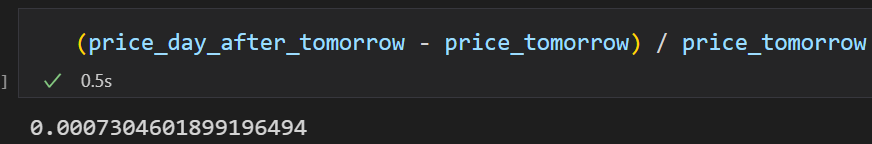

so in short for each stock and each day target is:

This is already calculated and stored in the Target variable.